The Greatest Guide To Fortitude Financial Group

The Greatest Guide To Fortitude Financial Group

Blog Article

The smart Trick of Fortitude Financial Group That Nobody is Discussing

Table of ContentsFortitude Financial Group Things To Know Before You Get ThisNot known Incorrect Statements About Fortitude Financial Group The Facts About Fortitude Financial Group RevealedGetting The Fortitude Financial Group To WorkNot known Details About Fortitude Financial Group

In a nutshell, an economic consultant assists people manage their money. Some financial experts, usually accounting professionals or legal representatives that specialize in trust funds and estates, are wealth supervisors.Normally, their emphasis is on educating customers and providing risk administration, cash money circulation evaluation, retirement planning, education preparation, spending and much more. Unlike legal representatives who have to go to legislation school and pass the bar or physicians who have to go to medical college and pass their boards, financial advisors have no particular unique needs.

If it's not via a scholastic program, it's from apprenticing at a financial advisory company. As noted previously, though, lots of advisors come from other areas.

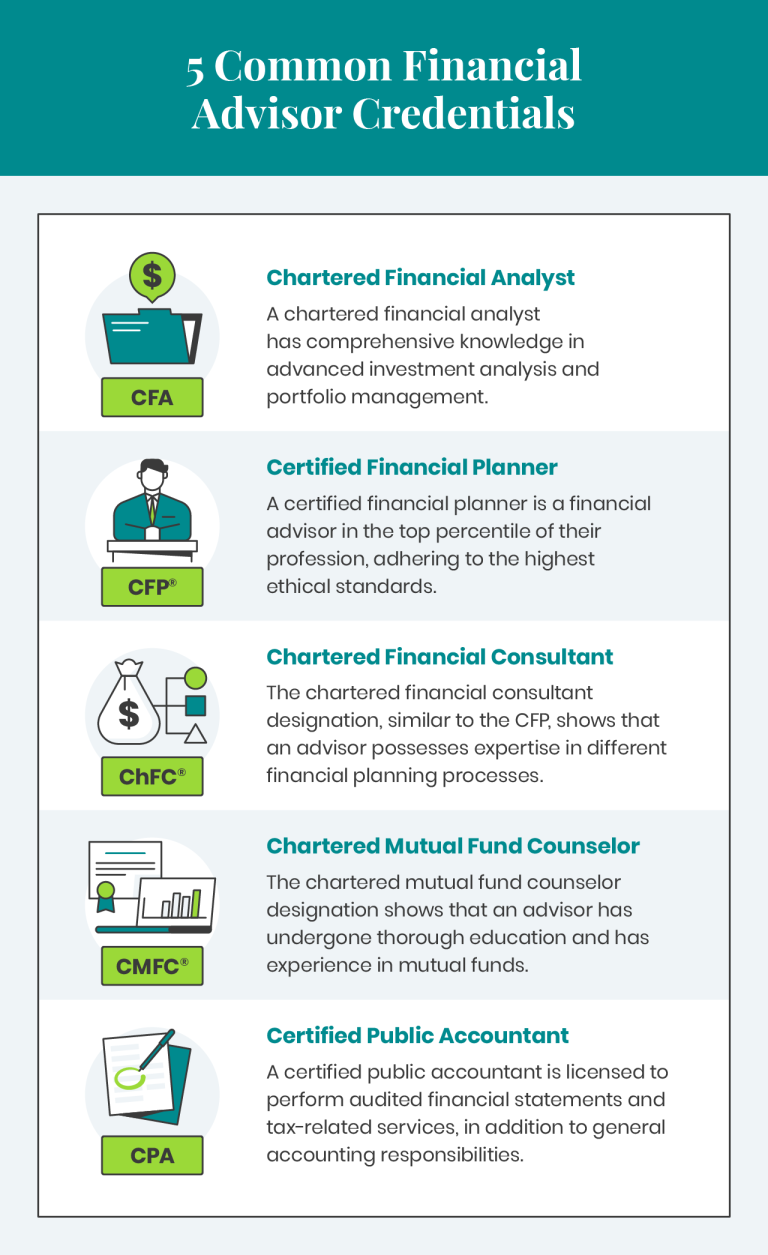

Or possibly a person who handles assets for an investment firm chooses they prefer to assist people and deal with the retail side of the company. Lots of financial experts, whether they currently have professional degrees or not, go through certification programs for more training. An overall monetary consultant certification is the qualified economic organizer (CFP), while a sophisticated variation is the chartered monetary expert (ChFC).

The Only Guide for Fortitude Financial Group

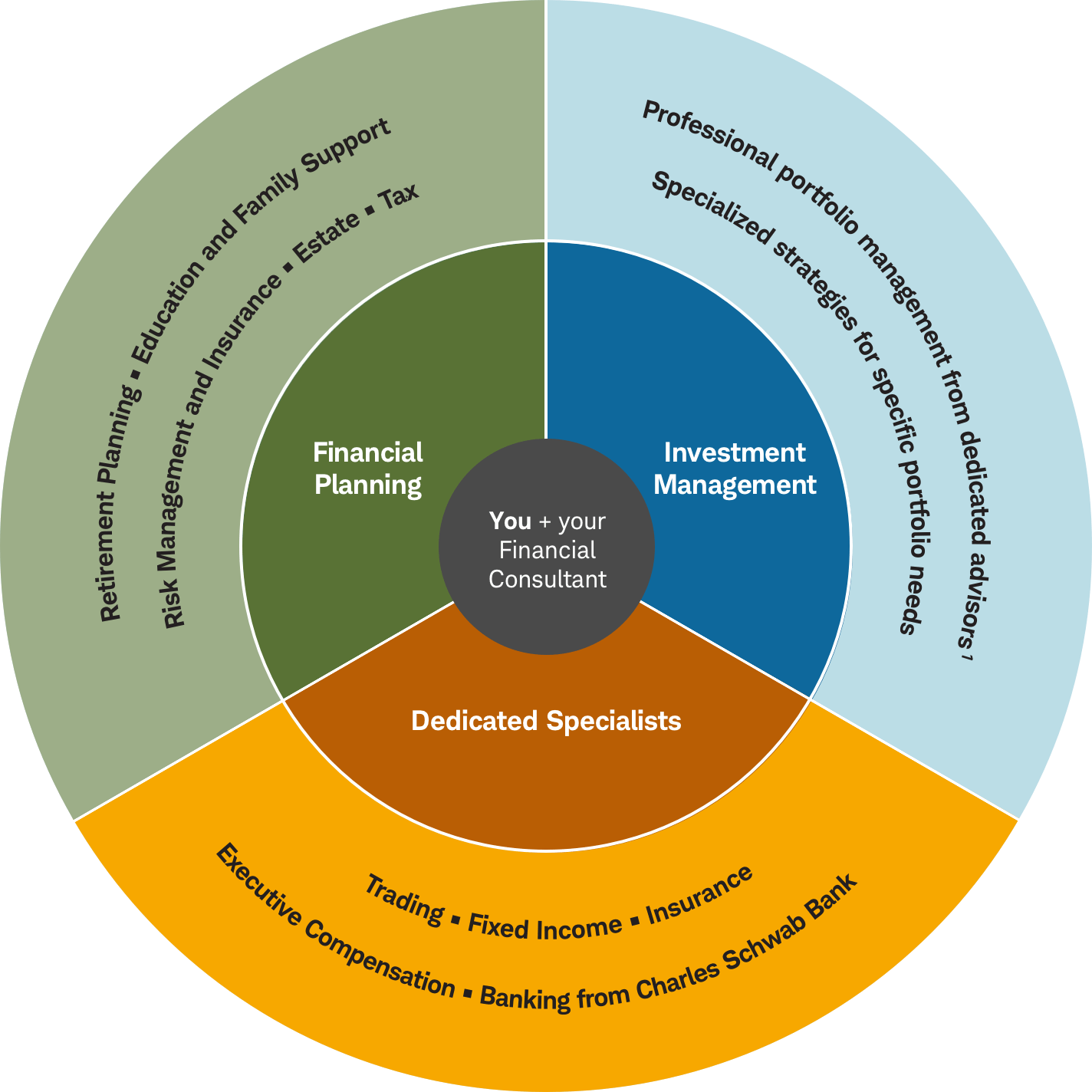

Usually, an economic consultant uses investment management, financial planning or wealth management. Financial investment management consists of developing your investment technique, applying it, monitoring your portfolio and rebalancing it when necessary. This can be on a discretionary basis, which means the advisor has the authority to make trades without your authorization. Or it can be done on a non-discretionary basis whereby you'll have to authorize off on individual professions and decisions.

It will certainly detail a collection of actions to take to attain your monetary goals, consisting of a financial investment plan that you can apply by yourself or if you want the consultant's assistance, you can either hire them to do it when or enroll in ongoing monitoring. Financial Advisor in St. Petersburg. Or if you have certain requirements, you can work with the consultant for economic planning on a job basis

Their names frequently state all of it: Securities licenses, on the various other hand, are much more concerning the sales side of investing. Financial experts who are likewise brokers or insurance policy agents often tend to have safety and securities licenses. If they straight acquire or offer supplies, bonds, insurance items or offer economic recommendations, they'll need specific licenses connected to those items.

The most popular securities sales licenses include Series 6 and Series 7 designations (https://filesharingtalk.com/members/600964-fortitudefg1). A Series 6 permit allows a monetary consultant to offer financial investment products such as shared funds, variable annuities, device investment company (UITs) and some insurance coverage products. The Series 7 permit, or General Stocks license (GS), allows a consultant to market most kinds of securities, like typical and preferred stocks, bonds, alternatives, packaged investment products and more.

About Fortitude Financial Group

Constantly make certain to inquire about economic consultants' fee routines. To find this details by yourself, visit the company's Form ADV that it submits with the SEC.Generally speaking, there are 2 sorts of pay frameworks: fee-only and fee-based. A fee-only advisor's single kind of compensation is via client-paid costs.

When attempting to understand just how much an economic consultant prices (Financial Advisor in St. Petersburg), it's important to understand there are a selection of settlement techniques they might use. Below's an overview of what you could run into: Financial advisors can get paid a percent of your total assets under administration (AUM) for handling your money.

Based on the aforementioned Advisory HQ research study, rates normally range from $120 to $300 per hour, often with a cap to just how much you'll pay in overall. Financial consultants can make money with a repaired fee-for-service model. If you want a basic economic plan, you might pay a flat charge to obtain one, with the Advisory HQ research study showing ordinary rates differing from $7,500 to $55,000, relying on your asset tier.

What Does Fortitude Financial Group Mean?

When an expert, such as a broker-dealer, offers you a monetary item, he or she gets a certain portion of the sale quantity. Some monetary experts who work for big brokerage firms, such as Charles Schwab or Fidelity, receive a salary from their company.

Report this page